Accounting and Finance

Management Reporting for Business Performance Review

Why Attend

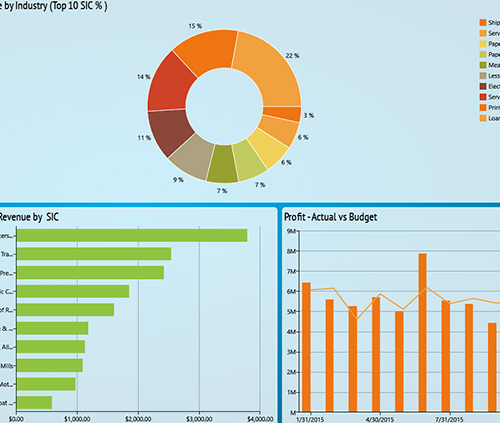

In this era when floods of information are available at our fingertips, it is essential for senior management and board members to have fast access to relevant and reliable information. Retrieving this information from different locations in the organization is inefficient, and the resulting information is disjointed. The solution is the Innovative Management Report (IMR) which brings together all the information necessary for decisions by the board and senior management. While the IMR may be put together by the CFO or controller's office, it is made of data generated and aggregated at different points in the organization. This course shows participants the information needed for high level decision making and how to present this information in a report that is clear, effective and easy to use by top management.

To build the IMR we start by analyzing the corporate environment. We then introduce an innovative balanced scorecard model which integrates corporate governance elements (related to investors, regulators and creditors) with other balanced scorecard elements. We also touch on Enterprise Risk Management (ERM) as per the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and we describe how to present the impact of risk on corporate objectives. In addition, we will describe how participants can use practical tools to incorporate into the IMR. These tools include margins, ratios and breakeven analysis for new projects as well as essential financial analysis of budgets, variances and financial KPIs.

Course Methodology

The course includes discussions and explanations by the consultant. Participants will be presenting and discussing case studies, engaging in workshops and preparing an actual sample report for a company of their choice which may be their current organization or a fictitious company.

Course Objectives

By the end of the course, participants will be able to:- Prepare an overview of company performance and inform decision makers accordingly

- Appraise important KPIs from different departments to measure efficiency

- Analyze the corporate situation in an innovative balanced scorecard and show the effect on objectives

- Identify which 'risk reports' to report and send to the board and senior management and what they should include

- Provide to the board valuable information from management accounting that is not available in regular financial reports

- Generate financial analysis beyond the budget variance report and include other financial KPIs

Target Audience

CFOs, group controllers, financial controllers, controllers from any level, senior accountants and accounting supervisors who work in reporting, management accountants, managers from different departments who work with risk management or balanced score card or financial analysis of budgeting or other financial areas, and managers, executives or independent directors interested in corporate governance.

Target Competencies

- Writing reports professionally

- Analyzing data

- Advising decision makers

- Preparing managerial accounting reports

- Interpreting and presenting data

- Measuring and reporting on department performance

Course Outline

- Brief on corporate performance

- Executive summary

- External environment analysis

- Internal environment analysis

- Department performance: KPIs

- Operations departments

- Sales department

- Production department

- Projects

- Support Services

- General services department

- HR department

- Accounting and finance department

- Operations departments

- Innovative 5 layers 'balanced scorecard'

- Linking performance to strategic objectives

- Laying the foundation with stakeholders and corporate governance

- Investors

- Regulators

- Creditors

- Learning and growth

- Employees

- Organization

- Processes, assets and products

- Client satisfaction and retention

- Performance measurement: profits and other

- Innovative GRC analysis and risk response

- High risks monitoring report

- New risks identified

- Responses chosen and controls implemented

- Risks materialized

- External risks materialized, effect and response

- Internal risks materialized, effect and response

- Financial statements and managerial accounting

- Income statement

- Shareholders’ equity

- Balance sheet

- Cash flow

- Notes to the financial statements

- Managerial accounting

- Income statement 'CM' approach

- Classification and explanation of costs (e.g. cost drivers)

- Margins, ratios and breakeven analysis

- Financial analysis of budgets and financial KPIs

- Variance report

- Variance analysis

- Budget forecast

- Financial KPIs

- Liquidity

- Efficiency

- Debt

- Profitability

REQUEST CALL BACK

Would you like to speak to one of our consulting advisers over the phone? Just submit your details and we’ll be in touch shortly.